Welcome To The Infinite World of Possibilities

Welcome to Quantace Blogs. Your One-Stop Blog for all the information related to Investing and Trading in Stock Markets

Infosys FY24 Guidance Reset and the Ensuing Impact

India’s technological titan, Infosys, recently shook markets with a revision of its FY24 guidance. This blog post presents a meticulous analysis of the potential ramifications of this decision on the stock market, along with a thorough evaluation of Infosys' Q1 2023 results.

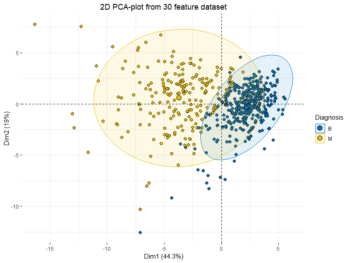

PCA-based Clustering: A Powerful Tool for Equity Markets

This blog post delves into the concept of PCA-based Clustering, its profound role in understanding the dynamics of financial equity markets, and its limitations. It explores the intersection of data science and financial markets, revealing how these advanced tools can empower financial decision-making and risk management.

ICICI Prudential Life Insurance: A Breakdown of APE Growth and the 4D Strategy

This blog post provides a comprehensive overview of ICICI Prudential's performance, focusing on the APE growth in 1QFY24. The post takes a deep dive into the factors influencing APE growth, introducing the 4D strategy deployed by ICICI Prudential. Moreover, it sheds light on the market expectations and future strategies

HDFC Bank’s 1QFY24 Results: A Comprehensive Analysis

This blog post provides a detailed and comprehensive examination of HDFC Bank's 1QFY24 results, highlighting pre- and post-merger performance. With a targeted focus on HDFCBANK's 1QFY24 PAT, the merger, YoY and RoA, readers will understand the financial dynamics underpinning this pivotal bank's operations.

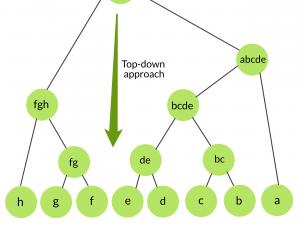

Hierarchical Clustering: Financial Market Analysis

This blog post delves into the powerful machine learning technique of Hierarchical Clustering. It explores its practical applications in India's financial markets and discusses its limitations. By comparing Hierarchical Clustering with K-Means Clustering, the post aims to give readers a thorough understanding of these key techniques in data science and AI. An illustrative example provides a practical understanding of the concept, making it accessible to under-graduate readers. The post concludes with an encouraging note on the importance of embracing such advanced methodologies in the rapidly evolving landscape of financial markets in India.

India’s Defence Sector: A Rising Force in the Global Arena

This blog will explore key trends, opportunities, and challenges in India’s defence sector and how it is transforming itself into a global player

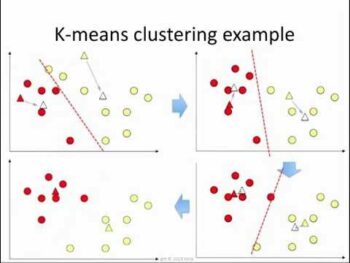

K-Means Clustering: Tool for Financial Market Analysis

This blog post demystifies the use of K-Means Clustering in financial market analysis, particularly in the context of the Indian markets. The post begins with a brief explanation of the K-Means Clustering algorithm, followed by a discussion on its practical applications, specifically in portfolio diversification. The limitations of the algorithm are also addressed, shedding light on its sensitivity to initial centroids, the predetermined number of clusters, and the influence of outliers. A simplified example illuminates how K-Means Clustering can be utilized in real-world scenarios. By the end of the blog, readers will understand how this powerful tool can help decode the complexities of financial markets and aid in strategic decision-making.

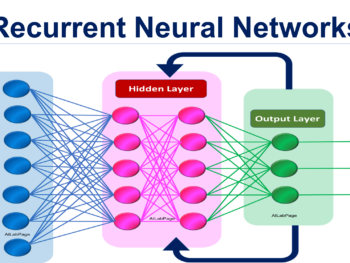

Recurrent Neural Networks: Financial Equity Markets

Explore the influential role of Recurrent Neural Networks (RNNs) in Indian Financial Markets. Dive deep into the core concepts, practical applications, and limitations of RNNs. Discover how RNNs differ from other neural networks such as Convolutional Neural Networks (CNNs) and Long Short-Term Memory (LSTM) networks. Comprehend these advanced concepts through a simple and engaging example, tailored for undergraduate readers.

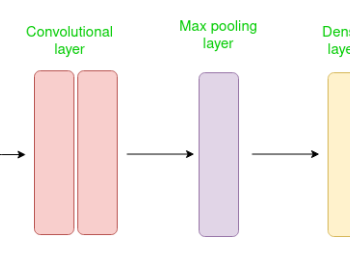

Convolutional Neural Networks: Financial Equity Markets

Dive into the fascinating world of Convolutional Neural Networks (CNNs) and their transformative role in the Indian financial equity markets. Learn about the unique structure and functionality that sets CNNs apart from traditional neural networks. Explore the various practical applications of CNNs in financial markets, from identifying market trends to aiding in high-frequency trading and fraud detection. Understand the challenges that come with implementing CNNs, such as the need for extensive data and the complexity of interpretation. And finally, grasp the workings of CNNs through a simple, relatable example.