Welcome To The Infinite World of Possibilities

Welcome to Quantace Blogs. Your One-Stop Blog for all the information related to Investing and Trading in Stock Markets

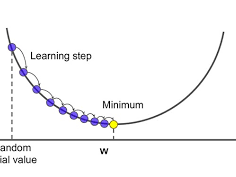

Gradient Descent in Machine Learning: Unleashing its Power in Financial Equity Markets

Explore the intriguing world of Gradient Descent, an essential algorithm in machine learning, and its application in the Indian financial equity markets. This blog post deciphers the concept, delves into its practical use in portfolio optimization, and unravels its limitations. A simple, intuitive example makes the complex concept accessible to undergraduate readers. We also draw connections with the decision tree algorithm, another significant tool in machine learning, and its implementation in financial markets.

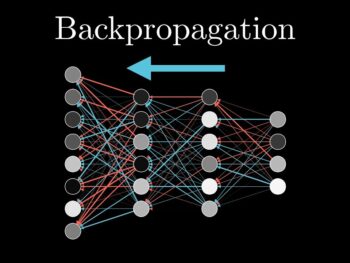

Backpropagation in Machine Learning

Dive into the intriguing world of backpropagation in machine learning and its profound impact on India's financial equity markets. This blog post unravels the concept of backpropagation, its practical applications and limitations in the financial world, and provides a simple example for better understanding. It further contextualizes backpropagation within the Indian financial markets, shedding light on its transformative role in driving financial technology in India.

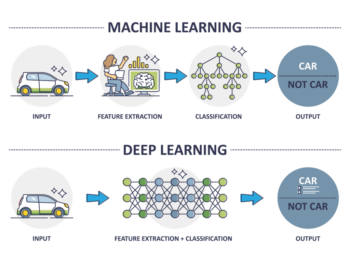

Deep Learning in Financial Markets

This blog post aims to demystify the complex world of Deep Learning and its applications in financial markets. Starting with a brief introduction to Deep Learning and its differentiation from Neural Networks, the post then dives into the myriad ways Deep Learning is revolutionizing the financial sector. From risk management and portfolio optimization to algorithmic trading, deep learning proves to be a game-changer. Despite its immense potential, the blog also throws light on its limitations. It further simplifies the concept through a relatable real-life example.

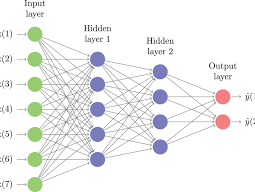

Neural Networks in Financial Markets

This blog post delves into the transformative role of Neural Networks in financial markets, with an emphasis on the Indian context. By exploring practical applications and discussing limitations, the post provides an easy-to-understand introduction to this complex topic. Furthermore, the blog sheds light on stock market predictions using Neural Networks and the growing role of Data Science & AI in India's financial equity markets.

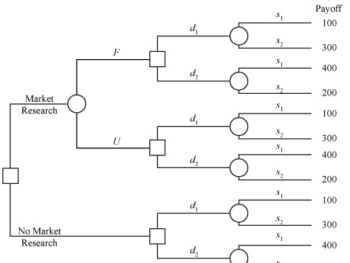

Decision Trees in Financial Markets

Unearth the power of decision trees in financial markets, focusing on the Indian market context. The blog will explore the concept of decision trees, their uses, and detailed examples with solutions. Further, it will delve into the ID3 decision tree algorithm and other advanced techniques. An engaging journey from understanding the basics to applying the advanced, this blog aims to make decision trees a comprehensible tool for undergraduates.

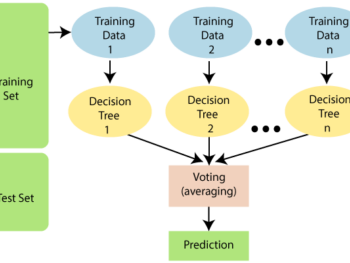

Mastering Random Forest: A Powerful Tool for Accurate Predictions and Dimension Reduction in Finance

In the unpredictable realm of financial markets, a dependable compass is essential to navigating the rough waters of fluctuating information. Today, let's unlock the might of a powerful duo that combines predictive accuracy and simplicity: the Random Forest algorithm.

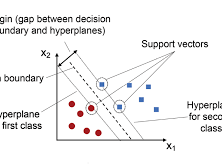

Embracing the Power of Support Vector Machines in Financial Markets

In the highly dynamic financial market world, predictive accuracy is the key to success. As a seasoned quantitative researcher, I have observed a range of methodologies applied to forecast market trends. Yet, one that stands out and continues to impress with its unique approach is the Support Vector Machine (SVM).

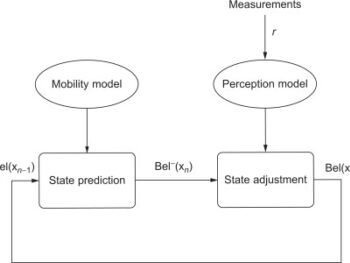

Bayesian Filters: Decoding the Magic in Financial Markets

Every day, the financial markets generate a gargantuan volume of data. Traders, investors, analysts, and portfolio managers are consistently seeking better tools and techniques to extract meaningful insights from this data. Today, we're spotlighting one such tool: Bayesian Filters. These tools, while not new, remain a largely untapped resource in the field of financial analytics.

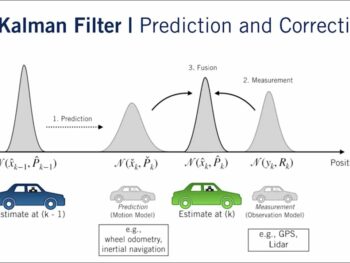

Harnessing the Power of the Kalman Filter in Financial Markets

Finance is a labyrinth of numbers, trends, and volatility. Amidst this complexity, making accurate predictions is the holy grail sought by analysts and investors alike. Among the myriad tools designed to support this cause, the Kalman Filter stands out due to its unique ability to interpret complex, real-time data with remarkable precision.