Bharat - The Theme of 2024

As dawn breaks over the bustling markets of the world, the economic climate seems to be whispering tales of change, challenge, and transformation. The year 2023 began with a world still reeling from the aftershocks of a global pandemic, geopolitical tensions simmering across continents, and economies navigating through the murky waters of inflation, trade conflicts, and shifting power dynamics. It's in these tumultuous times that the story of a nation's rise becomes not just a narrative of interest but a beacon of what's possible in the global economic order. This nation is India, a burgeoning economic superpower poised to redefine its position on the world stage.

The global economic climate today is nothing short of a rollercoaster ride. Economies worldwide are juggling the pressures of returning to pre-pandemic normalcy while battling the spectres of inflation and supply-chain disruptions. Countries are walking the tightrope between stimulating growth and preventing overheating, with central banks cautiously toggling interest rates. This economic volatility is more than just numbers fluctuating on a screen; it's about businesses adapting to new norms, consumers recalibrating their spending, and governments revising their economic blueprints. Each policy tweak, market swing, or innovation isn't merely a local event but a ripple across the global pond, affecting economies near and far.

The geopolitical landscape, too, is a canvas of intense and intricate relationships, power plays, and alliances. Recent events like the prolonged US-China trade tensions, the unsettling echoes of Brexit, and the unsettling rise of unilateralism over multilateral cooperation have redrawn economic and political boundaries. The Russia-Ukraine conflict has not only redefined European security and global diplomatic ties but has also sent shockwaves through energy markets, global supply chains, and strategic calculations worldwide. Each of these geopolitical shifts carries profound implications for global markets, trade routes, and economic policies, reemphasizing the intricate interplay between politics and economics.

Amidst this backdrop of global economic and geopolitical theatrics, India's story emerges as a compelling narrative of resilience, ambition, and strategic evolution. Once a colonial economy known more for its spices than its economic might, India today stands on the cusp of becoming the world's third-largest economy. It's a journey marked by liberalization reforms in 1991 that unleashed the entrepreneurial spirit, a demographic dividend that continues to fuel its labour market and consumption, and a series of recent economic reforms aimed at propelling it into a new era of growth and global integration.

India's rise is about the nation's transformative impact on the global economic and geopolitical landscape. The country's technological strides, its burgeoning start-up ecosystem, and its pivotal role in global supply chains underscore its growing influence. Furthermore, its strategic geographic location and renewed focus on defence and security play a crucial role in regional and global geopolitics.

As we delve deeper into India's ascent and its implications for the global economy, it's essential to appreciate the wider context it operates within. The nation's economic strategies, market reforms, and growth trajectory are intrinsically linked to the global economic climate and geopolitical shifts. Understanding this interconnection is crucial for anyone looking to grasp the dynamics of the global economy and India's emerging role within it.

Global Macroeconomic Landscape

The global macroeconomic landscape is a dynamic tableau reflecting the health and trajectory of the world's economies. Key indicators like GDP growth rates, inflation, trade balances, and employment rates offer insights into the vibrancy and challenges within this complex system.

GDP Growth Rates: The Gross Domestic Product (GDP) growth rate is a primary indicator of economic health. Over the past decade, the world has witnessed fluctuations due to events like the 2008 financial crisis and the recent COVID-19 pandemic. Developed economies have generally seen moderate growth, while emerging markets, particularly in Asia, have often outpaced them. Predictions from sources like the IMF suggest cautious optimism, with growth expected to stabilize but remain susceptible to pandemic aftershocks and geopolitical tensions.

Inflation Rates: Inflation is a critical indicator of the economic environment affecting purchasing power and monetary policy. The last decade has seen periods of low inflation in many developed economies, but recent supply chain disruptions and fiscal stimuli have led to a notable uptick globally. Economies now face the delicate task of curbing inflation without stifling growth, with future trends heavily dependent on policy responses and the normalization of global trade and supply.

Trade Balances: Trade balances reflect an economy's status in global trade and are influenced by factors like currency strength, global demand, and trade policies. Shifts have been particularly pronounced in recent years with changing trade dynamics, including the U.S.-China trade war and Brexit. Future shifts will likely hinge on evolving production patterns and the reconfiguration of global supply chains.

Employment Rates: Employment rates are a lagging indicator, often reflecting the broader health of an economy. The pandemic-induced economic downturn led to significant job losses worldwide, with recovery rates varying significantly across countries. Future employment trends are expected to gradually improve as economies recover, though much depends on business adaptations and consumer confidence

Geopolitical Tensions and Their Impacts

In the grand chessboard of international relations, geopolitical tensions often dictate the ebb and flow of global markets and economies. Today's world, interconnected yet divided by political and ideological boundaries, witnesses frequent tremors of geopolitical shifts, each sending ripples across continents.

Take the US-China trade war, for instance, a battle of tariffs and economic posturing that's more than just a bilateral tiff. It's a manifestation of shifting global power dynamics and competing economic models. The repercussions extend beyond the two nations, affecting global supply chains, altering trade routes, and reshaping economic alliances. Industries worldwide recalibrate, countries hedge their bets, and markets respond with volatility, reflecting the uncertainty and realignment. As this tug-of-war continues, its ramifications will likely influence investment strategies, market openings, and economic policies globally.

Brexit is another geopolitical earthquake, with aftershocks still being felt across Europe and beyond. The UK's decision to leave the European Union not only redefined its economic and political relations but also sparked conversations about national sovereignty, trade independence, and regional unity. Financial markets swayed with each negotiation twist, currencies fluctuated, and businesses re-evaluated their European footprints. The long-term impacts of Brexit will unfold over the years, but it already serves as a cautionary tale of how political decisions can lead to economic isolation or adaptation.

These geopolitical shifts have historically affected markets in various ways - sometimes triggering immediate panic, other times leading to a gradual realignment of economic priorities. The 1973 oil crisis, the fall of the Berlin Wall, and the Arab Spring - each event left its mark on economic history, illustrating how political upheavals can lead to economic transformations.

India's Economic Ascent: The Bharat Story

India's narrative in the global economy is an unfolding saga of resilience, strategic reforms, and demographic dynamism, colloquially termed "The Bharat Story." It's a journey from being an agrarian economy to a burgeoning global powerhouse, marked by key factors that have catalyzed its ascendancy.

The demographic dividend stands as India's first ace. Boasting one of the youngest populations in the world, India turns its demographic scenario into an economic opportunity. This youthful vigour translates into a large, dynamic workforce, driving consumption and fueling the engines of growth. The demographic advantage is more than just numbers; it's about the potential that comes with a nation teeming with young, aspirational minds ready to innovate, build, and lead.

Policy reforms have been pivotal in steering India's economic ship. The liberalization of the 1990s opened doors to foreign investments, revamping the industrial sector and services. Recent reforms, including the Goods and Services Tax (GST) and the push for digital transactions, further streamline business processes, reduce red tape, and enhance transparency. These reforms aren't just legislative changes; they are transformative shifts that have redefined the business environment and spurred economic activity.

Technology adoption and digital innovation form the cornerstone of modern India. The nation's leap into the digital era, with initiatives like Digital India and Aadhaar, has revolutionized everything from financial services to governance. Success stories abound, from the meteoric rise of IT giants to innovative startups redefining global tech landscapes. The technology tale is one of empowerment, innovation, and a vision to lead.

Infrastructure development acts as the scaffolding for India's growth, with massive investments in roads, airports, digital networks, and smart cities. These projects are more than just physical structures; they are the arteries that will carry India's economic ambitions forward, facilitating trade, connectivity, and urbanization.

Case studies across sectors—from IT and pharmaceuticals to automotive and renewable energy—showcase India's economic metamorphosis. Companies like Tata, Reliance, and Infosys are not just domestic names but global ambassadors of India's industrial and service capabilities. Their stories are testimonials of a nation's potential to innovate, scale, and lead.

"The Bharat Story" is a mosaic of demographic shifts, reformative strides, technological leaps, and infrastructural expansion. It's a story of a nation's journey to economic prominence, characterized by strategic planning, adaptive policies, and an unyielding spirit of innovation. As the world watches, India continues to carve its path, not just as an economy to watch but as a formidable player shaping the future global order.

The Imperative for Defence

In the realm of national strategy and sovereignty, a robust defence sector is not a choice but a necessity. For India, with its complex geopolitical challenges and ambitious economic goals, bolstering defence is more than a strategic move—it's an imperative. The nation's defence narrative is evolving, marked by significant historical contexts, modern developments, and a vision that looks firmly into the future.

Historically, India's strategic location and its relationships with neighbouring countries have necessitated a strong defence posture. From the wars post-independence to the ongoing border tensions, India's military history is a testament to its need for vigilance and strength. But today, the context has expanded; it's not only about protecting borders but also about projecting power, securing trade routes, and participating in global security dialogues. Recent developments reflect this shift. India is increasing its defence budget, investing in new technology, and focusing on self-reliance through programs like 'Atmanirbhar Bharat' (Self-reliant India). The nation is not just importing cutting-edge technology but also innovating within its borders, seeking to position itself as a global defence exporter in the future.

India's defence initiatives are multifaceted. They include modernizing the armed forces with new aircraft, submarines, and missile systems; bolstering cyber and space defense capabilities; and enhancing the operational readiness and mobility of the troops. The procurement strategies are becoming more sophisticated, focusing on a mix of global procurement for cutting-edge technology and promoting indigenous development to build a self-reliant defence industrial base. These initiatives are complemented by policies aimed at encouraging private sector participation and foreign direct investment in defence manufacturing.

The drive towards indigenous development has led to several success stories. Programs like the Light Combat Aircraft (LCA) Tejas, the nuclear submarine INS Arihant, and the development of the BrahMos missile system in collaboration with Russia are just a few examples of India's growing prowess in defence technology.

In sum, the imperative for defence in India is a complex interplay of historical lessons, strategic necessities, and future aspirations. It's about safeguarding sovereignty, ensuring economic growth, and emerging as a responsible global player. As India continues to navigate its path on the world stage, its defence sector remains a critical element of its national strategy and global standing.

The Value Proposition of Indian PSU Stocks

Indian Public Sector Undertaking (PSU) stocks stand as bastions of stability and value in an otherwise volatile market. These stocks, representing critical sectors like banking, energy, and infrastructure, are not just economic entities but reflections of India's developmental priorities. Known for their consistent dividend history, PSUs offer a compelling blend of dividends and performance.

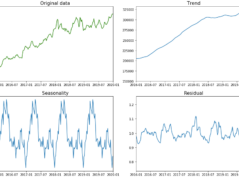

As the Indian economy grows, these entities are expected to play pivotal roles, thereby enhancing their investment appeal. A graph depicting the performance and dividend yields of select PSU stocks would show a pattern of resilience and steady returns, attractive in both buoyant and subdued markets. For investors seeking stable yet growth-oriented investments, PSU stocks provide a foundation built on the bedrock of India's economic narrative and the promise of its future.

Investment Thesis: Seizing Opportunity in Bharat’s Growth

The investment landscape, like a vast ocean, is in constant motion, shaped by the winds of global trends and geopolitical shifts. As investors, our compass must align with these forces to navigate toward prosperous shores. India's meteoric rise in the global economic theatre presents a compelling case for investment, with its robust PSU sector shining as a beacon of stability and opportunity.

India’s economic ascent is not a mere stroke of luck but the result of strategic policy reforms, a burgeoning demographic, and a tech-driven leap forward. Amidst a world of economic uncertainty, India stands as a testament to growth and resilience. For investors, this represents a fertile ground for investment—a market where the potential is matched by progress.

Geopolitical shifts, while often viewed as risk factors, can also create fertile ground for strategic investments. India's defence sector, bolstered by the government's commitment to self-reliance, opens a vista for long-term growth. As the country forges new alliances and enhances its defence capabilities, sectors like aerospace, cybersecurity, and defence manufacturing emerge as attractive prospects.

The crown jewels, however, are the Public Sector Undertakings (PSUs). These entities, with their strong dividend yields and government backing, offer a blend of security and value that is hard to ignore. In an era where market volatility can unsettle the most seasoned investors, Indian PSUs stand as pillars of stability.

For those considering entering the Indian market or diversifying their investments, the strategy should be twofold: capitalize on the growth potential of India's burgeoning sectors like technology and renewable energy, and anchor this with the steady, reliable returns from PSU stocks. This balanced approach harnesses India's dynamic growth while cushioning against the inherent risks of emerging market investments.

Amidst the global symphony of fluctuating economies and shifting geopolitical landscapes, India orchestrates its audacious pursuit of a 5 trillion USD economy—a vision cast by Prime Minister Shri Narendra Modi. It's a vision that requires the harmony of India's diverse sectors, each playing a critical role in the nation's growth story. At Quantace, we've tuned into this melody of progress, creating a bespoke investment strategy that resonates with Bharat's ambitions.

Our Quantace 5 Trillion India Investment Basket is a curated ensemble of high-growth stocks, a concentrated treasury of 18-22 picks from the top 750 universe, poised to thrive within India's envisioned economic tapestry.

Our investment thesis centres on embracing India's upward economic momentum while finding solace in the strong fundamentals of PSU stocks. It's about being agile enough to ride the wave of India's growth sectors, prudent enough to seek the safety of PSUs, and wise enough to see the opportunity within the complexities of the global economic order. This approach does not chase trends; it builds upon a vision of India's future, crafting an investment poised for both growth and resilience.

Conclusion: Embracing the Economic Renaissance

As the curtain falls on our exploration of India's economic renaissance and its interplay with the broader global narrative, a few key themes resonate. The meticulous dance of global macroeconomics and the intricate ballet of geopolitics set the stage where India emerges as a protagonist. For investors, appreciating this performance is crucial; it requires a keen eye on the flux of global trends and an understanding of the strategic cadences that influence markets.

India's story, punctuated by its demographic dividend, technological leaps, and policy reforms, unfolds like an epic, with every chapter promising growth and opportunity. The PSU stocks, with their reliable dividends, offer a chorus of stability amidst the dynamic symphony of India's burgeoning sectors. This harmonious blend of growth and stability strikes a chord with those seeking to diversify their investments and invest in a future where India plays a leading role.

Looking ahead, the global economy continues to navigate through a labyrinth of challenges and opportunities, with India carving its path, influencing and being influenced by the grand economic confluence. The potential for growth in this emerging economic superpower is as vast as it is vibrant, inviting investors to partake in its journey towards an unprecedented economic milestone.

In closing, let this be a clarion call to action: Stay informed, for knowledge is the compass that guides investment decisions. Diversify, for in the multitude of markets lies the wisdom of balance. Explore, for the Indian market is a canvas of potential, rich with the hues of possibility. Embrace the economic renaissance, and may your investments flourish in the fertile soil of opportunity that is 'Bharat'.

Follow Quantace Research

-------------

Why Should I Do Alpha Investing with Quantace Tiny Titans?

1) Since Apr 2021, Our premier basket product has delivered +120% Absolute Returns vs the Smallcap Benchmark Index return of +45%. So, we added a 76% Alpha.

2) Our Sharpe Ratio is at 2.4 vs Benchmark's 0.5

3) Our Annualised Risk is 20.4% vs Smallcap100 Benchmark's 21%. So, a Better ROI at less risk.

4) It has generated Alpha in the challenging market phase.

5) It has a good consistency and costs 4500 INR for 6 Months.

-------------

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

-------------

#future #machinelearning #research #investments #markets #investing #like #investment #assurance #management #finance #trading #riskmanagement #success #development #strategy #illustration #assurance #strategy #mathematics #algorithms #machinelearning #ai #algotrading #data #financialmarkets #quantitativeanalysis #money