Source: Faizan Ansari, Analytics Vidya

Cross Validation in Quantitative Finance

In the dynamic world of finance, predicting market movements remains a challenge that professionals grapple with daily. At the heart of this challenge lies a technique revolutionising how we approach financial modelling: Cross Validation. Particularly in the Indian context, with its unique market dynamics and rapid digital transformation, understanding this technique becomes paramount.

Understanding Cross Validation:

Cross-validation, a term often echoed in the corridors of machine learning, is a robust method to assess the performance of models. But what exactly is it?

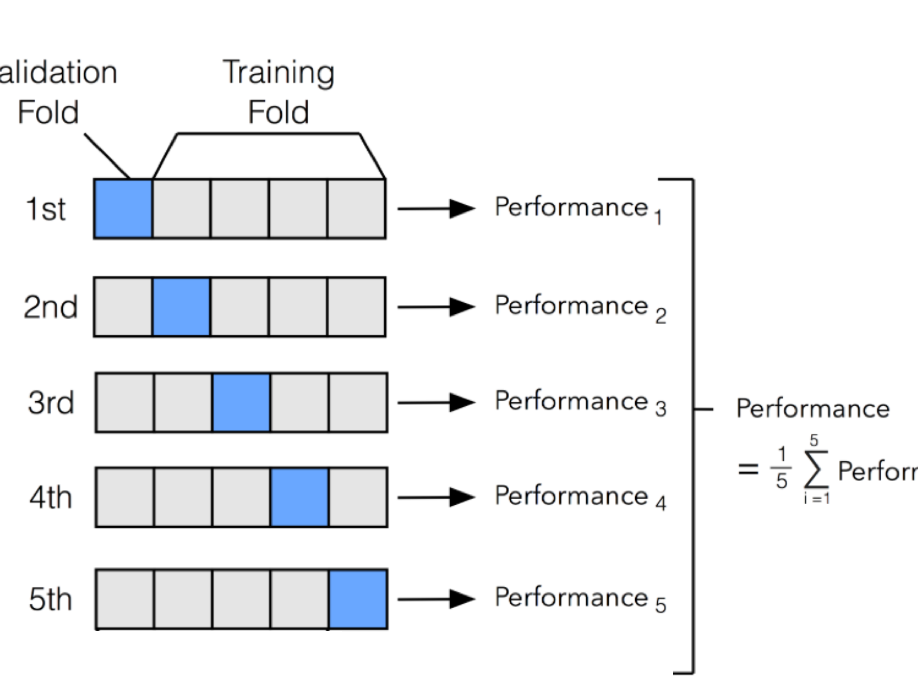

Cross-validation at its core involves partitioning a data sample into complementary subsets. The model then gets trained on one subset (the training set) and validated on the other subset (the validation set). This process helps in gauging the model's performance and its ability to generalize to an independent dataset.

Within this realm, k-fold cross-validation emerges as a popular technique. Here, the original sample is divided into 'k' equal-sized subsamples. Out of these, a single subsample remains as the validation data and the remaining 'k-1' subsamples serve as training data. The process repeats 'k' times, with each of the 'k' subsamples used exactly once as validation data. A variant is the 5-fold cross-validation, where 'k' equals 5.

Practical Application in Financial Markets:

Cross-validation plays a pivotal role in the bustling financial markets, especially those as diverse and vibrant as India's. With the surge in data science and AI applications in finance, this technique ensures that financial models remain robust and adaptable.

Consider the equity markets. Investors and fund managers alike rely on models to make informed decisions. Whether forecasting stock prices, assessing market risks, or optimizing portfolios, the accuracy of these models can mean the difference between profit and loss. By providing a holistic view of a model's efficacy, cross-validation becomes an indispensable tool in a financial expert's arsenal.

Limitations of Cross-Validation:

While cross-validation is a beacon of model validation, it comes with its challenges. One primary concern revolves around computational resources. Especially with voluminous datasets, the technique can be resource-intensive.

Another challenge is the potential for overfitting. If misapplied, cross-validation might lead to a model that fits the training data too closely, failing to generalize well to new, unseen data.

Moreover, in financial time series data, temporal structures can pose challenges. Traditional cross-validation techniques might not always capture these nuances, leading to less-than-optimal model performance.

Real-world Example: Rolling Window Strategy:

To bring the concept closer to home, let's delve into a practical example relevant to the Indian markets: the Rolling Window Strategy.

Imagine a dataset encapsulating 20 years of stock market movements of a prominent Indian company. Through cross-validation, one might adopt a rolling window strategy. Here, the model hones on a 5-year span and then assesses its predictions for the upcoming month. Subsequently, the window shifts by a month, and the process iterates.

Such a strategy ensures the model remains perpetually validated against recent data, fortifying its adaptability to market fluctuations. In the ever-evolving landscape of the Indian stock market, where factors ranging from policy changes to global events can sway stock prices, such adaptability becomes crucial.

Critical Insights from Cross-Validation in Finance:

Cross Validation, with its intricate techniques and profound impact, offers several insights:

- Robustness: In the volatile world of finance, a model's robustness can be its most significant asset. Cross-validation ensures models remain resilient against overfitting and underfitting.

- Holistic View: Cross-validation offers a panoramic view of a model's performance by training and testing on different data subsets, ensuring no data point goes unnoticed.

- Adaptability: A model's ability to adapt to new data is paramount, especially in markets as dynamic as India's. Cross-validation, with its iterative approach, ensures models remain adaptable and up-to-date.

Sample Python Code for Cross-Validation:

Here's a simple example of performing k-fold cross-validation using Python's scikit-learn library:

# Import necessary libraries

from sklearn.datasets import load_iris

from sklearn.ensemble import RandomForestClassifier

from sklearn.model_selection import cross_val_score

# Load the iris dataset as an example

data = load_iris()

X = data.data

y = data.target

# Initialize a classifier (Random Forest in this example)

clf = RandomForestClassifier(n_estimators=50, random_state=42)

# Perform 5-fold cross validation

scores = cross_val_score(clf, X, y, cv=5)

# Print the accuracy for each fold

for i, score in enumerate(scores, 1):

print(f"Fold {i}: Accuracy: {score:.4f}")

# Print the average accuracy

print(f"Average Accuracy: {scores.mean():.4f} +/- {scores.std():.4f}")

This code will:

- Load the iris dataset.

- Initialize a Random Forest classifier.

- Perform 5-fold cross-validation on the dataset using the classifier.

- Print the accuracy for each fold and the average accuracy.

You can replace the classifier and dataset with any other classifier or dataset of your choice. The cross_val_score function makes it easy to perform k-fold cross-validation.

Conclusion:

Cross Validation, a cornerstone in the world of machine learning, has etched its significance in the realm of Quantitative Finance. As the Indian markets continue to evolve, with digital transformations and global influences shaping its course, the role of robust financial modeling becomes ever more critical. Armed with the insights from Cross Validation, professionals stand better equipped to navigate the intricate tapestry of the financial world.

Found this exploration into Cross Validation insightful? Share your thoughts, experiences, or queries in the comments below. And if this post added value to your understanding, consider sharing it with peers and fellow enthusiasts. Together, let's demystify the world of Quantitative Finance.

Follow Quantace Research

-------------

Why Should I Do Alpha Investing with Quantace Tiny Titans?

1) Since Apr 2021, Our premier basket product has delivered +88% Absolute Returns vs the Smallcap Benchmark Index return of +25%. So, we added a 63% Alpha.

2) Our Sharpe Ratio is at 1.4.

3) Our Annualised Risk is 20.1% vs Benchmark's 20.4%. So, a Better ROI at less risk.

4) It has generated Alpha in the challenging market phase.

5) It has a good consistency and costs 6000 INR for 6 Months.

-------------

Disclaimer: Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

-------------

#future #machinelearning #research #investments #markets #investing #like #investment #assurance #management #finance #trading #riskmanagement #success #development #strategy #illustration #assurance #strategy #mathematics #algorithms #machinelearning #ai #algotrading #data #financialmarkets #quantitativeanalysis #money