Bullish Setup For July - A Strong Case

Empirical Evidence shows that you should be long NIFTY in July 2022. We call it the classic Three Down One Up Setup

You should be Long NIFTY for July 2022

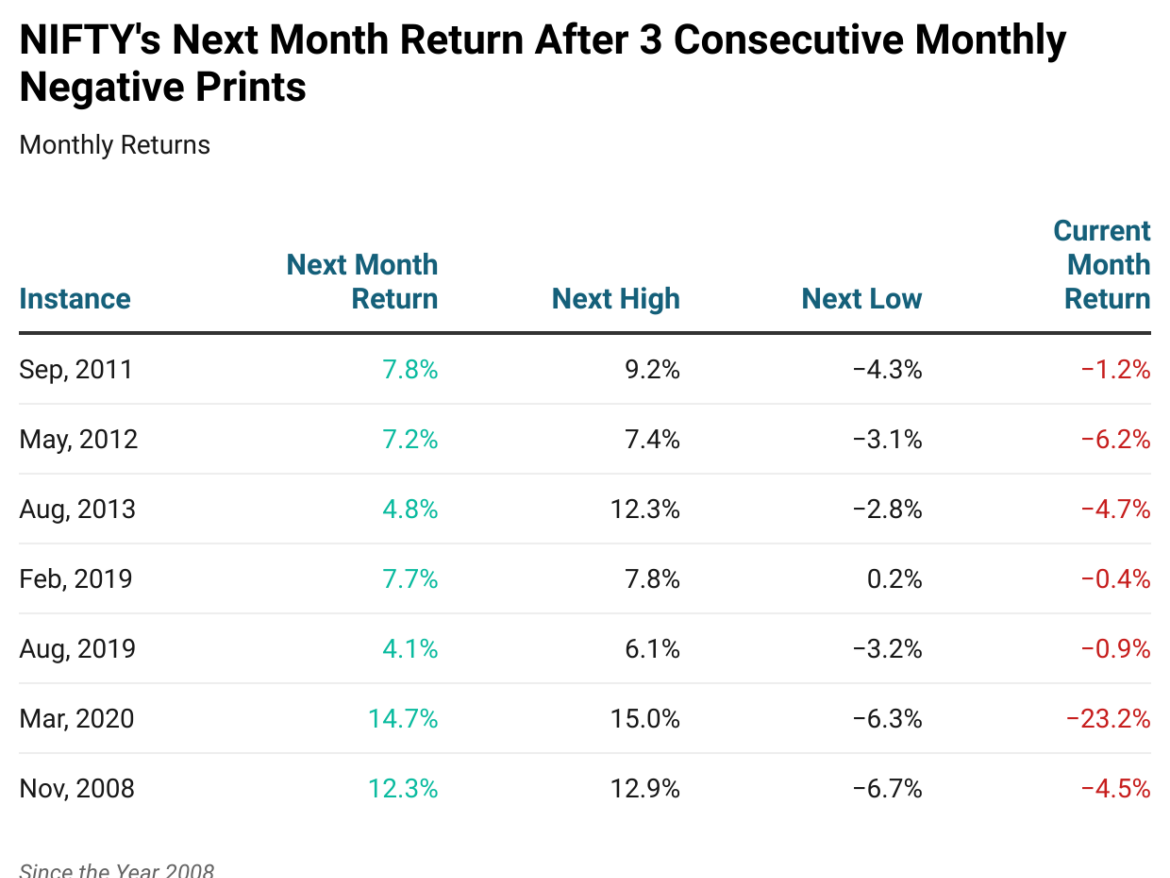

Since the year 2008, there had been 7 instances where NIFTY had printed negative returns for 3 consecutive months. Interestingly the following 4th month ended up positive in all instances. The latest instance was March 2020

NIFTY had printed an average return of 8.4% in the next following month. With the Average High being 2.7x the Average lows. Hence, July month calls for a Bullish Setup

Mar 2020 had been an exceptional month where NIFTY had printed a -23% return. But, in the other 6 instances, the index was down -3.0% in the third month. Currently, NIFTY is down 4.5%

We can play this setup through July Options

NIFTY Target: 17000 with NIFTY SL : 15200

1) NIFTY 15200/15600/16000 Bull Call Ladder

Reward to Risk: 3.45

Leg 1: Buy 50 (1 Lot)16000 CE of 28-Jul-22 at 256.25 Leg 2: Buy 50 (1 Lot) 15600 CE of 28-Jul-22 at 461.95 Leg 3: Sell 50 (1 Lot) 15200 CE of 28-Jul-22 at 726.05

2) NIFTY 16000/17000 Bull Call Spread

Reward to Risk: 2.25

Leg 1: Buy 50 (1 Lot) 16000 CE of 28-Jul-22 at 256.25 Leg 2: Sell 50 (1 Lot) 17000 CE of 28-Jul-22 at 30

For Fresh Investments

We suggest a 40%/30%/30% Rule. Where investors can deploy 40% of Fresh capital now, 30% after 1 Month and the remaining 30% after 2 Months

Stocks and Sectors we like for July

Banks : ICICIBANK, HDFCBANK and KOTAKBANK

FMCG : ITC, BRITANNIA and TATACONSUM

Pharma :SUNPHARMA and CIPLA

Sectors like Metals and Energy could underperform the NIFTY Index in July

Investments/trading are subject to Risk and hence could result in capital loss. We are not responsible for Profits/Losses. So, consult your financial advisor before making any decisions